audit vs tax big 4

Ability to specialize in a highly demanded practice. I used to work as an intern in Audit and now im working in TS ill tell you the differences similarities so youll get clearer picture.

Big 4 Accounting Firms Ranking Revenue And Salary Igotanoffer

So in term of actual works in daily basis the differences are.

. Page 1 of 1. 3 reactions 10 months. At the entry level positions both industry will be looking for similar personality and soft skills.

Both tax and audit are within a big four. Audit vs Tax Tax vs Audit. In depth tax knowledge that can be.

Op 3 yr. 1 More predictable hours less busier than audit busy season Dont get me wrong Tax has busy seasons too. Corporate Tax 1 20.

In fact its rare now to work at one place or even one industry until retirement. Possible exit to controller or CFO more client oriented work more career autonomy than Tax. Often longer and more intense busy seasons than tax.

Then issuing a report that says things are fine but if they are not its not your fault. Often menial tasks but hey this is accounting after all. Today we will be covering the pros and cons of working in audit or tax accounting at the big 4 accounting fir.

Its called a learning experience you learn from it and you move on to something better. Tax- figuring out ways for corporates to get out of their obligations multiplying profit by the tax rate. You dont usually leave without leaving a host of new work for people to do.

In all seriousness the tax vs audit dilemma is a pretty big decision. The market isnt nearly as big for problem finders. Like Reply Share.

I do international tax and dont have a big line of family and friends I can help with. Not that unusual for an university graduate to receive an offer for big 4 audit and consulting job through on campus recruiting. Its a round-about way of doing things but I think audit will at.

Often less competitive and easier to land a job. Im in corporate tax for a publicly-traded tech company but was previously in corporate tax for a large life insurer - pretty much every one of my colleagues Ive worked with for the past 10 years came from B4 Tax a handful like myself came from smaller regional firms. Here are the rules just follow them a whole lot of memorizing and research.

From there you might see more of what you want. Answer 1 of 3. Start new discussion reply.

Audit people on the other hand tend to be more focused on logic and reason. Which one sounds more like you. Like Reply Share.

I recently got an offer to become a Tax Associate with the Big 4 working specifically on financial instruments. Tax people tend to be more rules based. 1 reactions 10 months.

A lot more traveling sometimes traveling just means long commutes Tax Pros. In audit youll do a lot of procedures in order to test FS accounts. The rest can be trained.

Big4 Full time audit vs tax. Audit - Asking for loads of paperwork and data and messing around in excel for a month or so. You are not tied down to only working in tax or only working in audit your entire career.

More intense work schedule especially during busy seasons lots of travelling skills wouldnt be as transferable to a private practice generally lower starting pay. 1 Will I have the same opportunities down the. I have a few questions.

Ago CPA B4 Audit - FPA. I would say if no boutique consultingIB options pop up go to audit kick ass there and then request a move internally to TAS or if they refuse go to another Big 4s practice in advisory. Many aspects of an audit are left up to your professional judgment so there isnt a specific rule to go by.

I really like audit but dont mind tax. There is conflicting information from online sources regarding differences in pay for auditors vs. Moving from audit to TAS isnt easy but isnt like getting into MBB either.

Both supply such services to companies. Audit is a type of role which a person will see the world differently. Corporate Tax or Audit for Better Exit Opportunities.

Some sites state that lower level audit staff jobs are more plentiful than tax staff positions starting out and might offer higher initial pay. Get your experience typically two years before getting your CPA license. Based on almost 7 years at a Big 4 accounting firm I have compiled a list of 5 reasons why you might want to choose Tax.

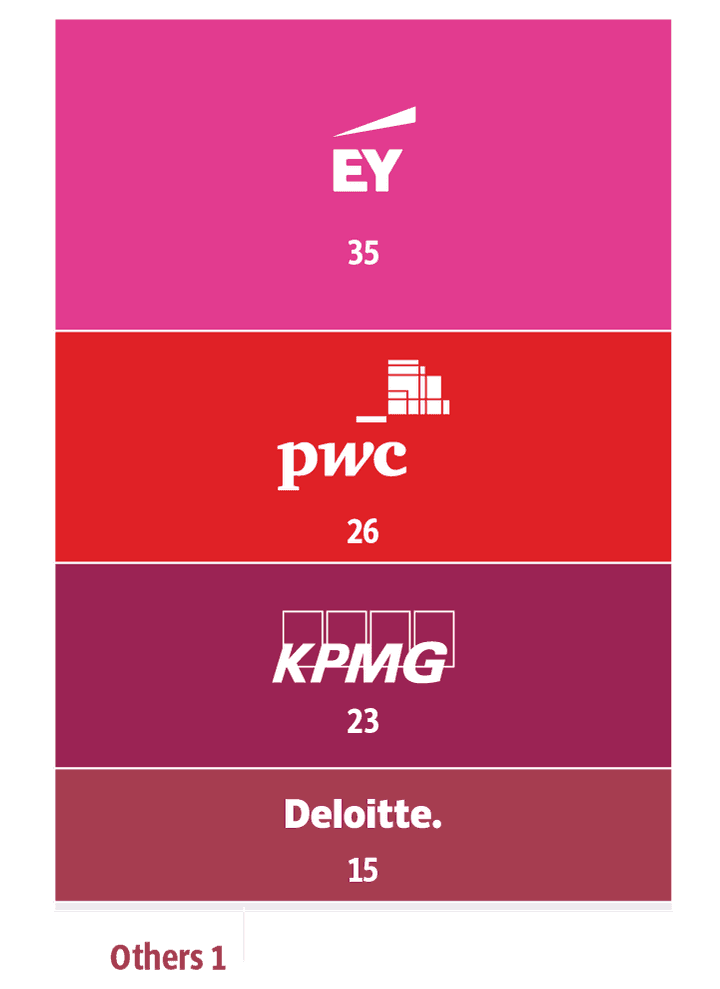

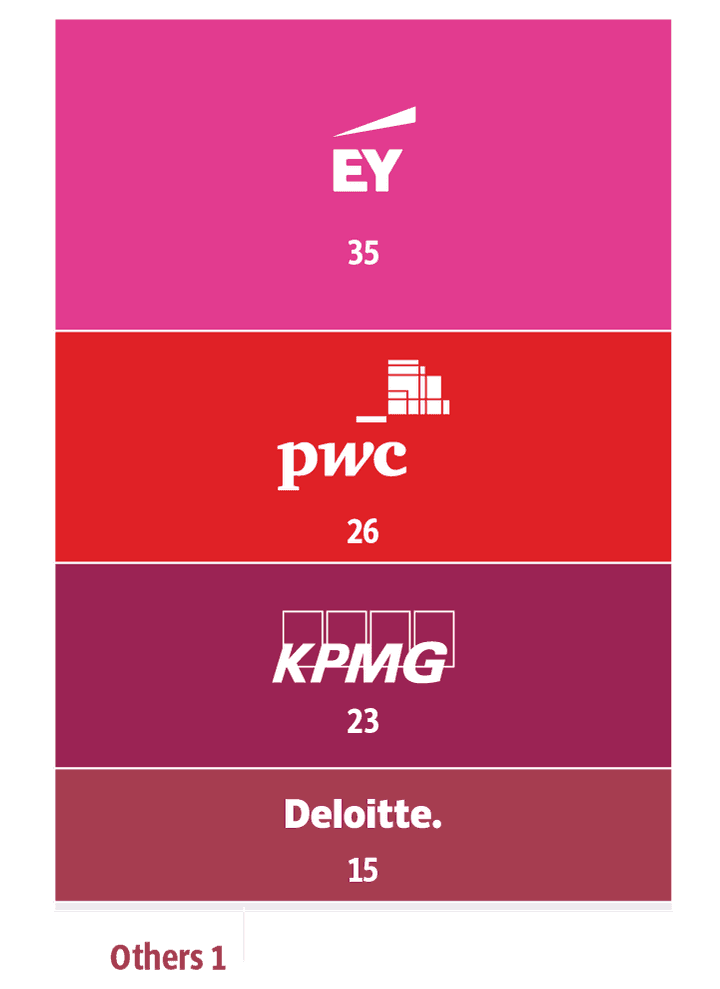

To Big 4 And Mid Size Firm Accountants Which Is More Important Prestige Or Culture Accounting Firms Accounting Audit Services Audit besides the latter may have a better exit opportunity. In summary there is little difference between the big four firms but if you want to focus on digital consulting work then Deloitte may be the best choice for you for tax it is probably PwC and for audit there is probably negligible difference and so the 10 higher salary at EY and PwC is probably the deciding factor. Which practice is better for you Audit or Tax.

You are currently posting as KPMG 3. However other sites argue that tax professionals have higher initial earning power. However at this time all the audit position are full and I wanted to gain experience with the Big 4 as they are the best places to start a career.

Big 4 Audit Firms Kpmg Deloitte Ey And Pwc Analytics Steps

Big 4 Accounting Firms Ranking 2021 Edition Who Is The Best

The Big 4 Accounting Firms The Complete Guide

Big 4 Accounting Firms Ranking Revenue And Salary Igotanoffer

Deloitte Kmpg Pwc Ey Die Big Four

Deloitte Kmpg Pwc Ey Die Big Four

Deloitte Kmpg Pwc Ey Die Big Four

Interviewing A Big 4 Auditor Pwc Kpmg Ey Deloitte I Deloitte Auditor I Career Talk Series I Youtube

Big 4 Transaction Services Careers Recruiting And Exits

The Practice The Reemergence Of The Br Big Four In Law

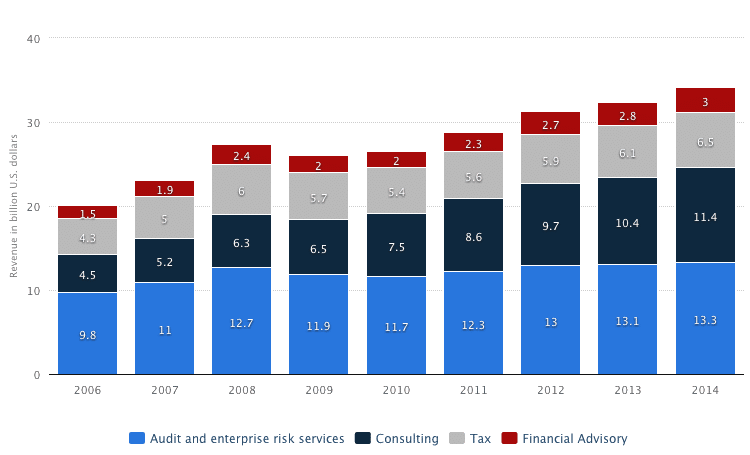

Big Four Revenue By Function 2021 Statista

Big 4 Accounting Firms Largest Accounting Firms In The World

Deloitte Kmpg Pwc Ey Die Big Four

The Big 4 Accounting Firms The Complete Guide

How Does The Hierarchy At The Big Four Pwc Ey Kpmg Deloitte In Their Consultancy Wings Compare To One Another In Terms Of Seniority Quora

Big Four Auditors Face Scrutiny And Reform In Wake Of Corporate Collapses International Bar Association

Big 4 Accounting Firms Ranking Revenue And Salary Igotanoffer

Difference Between Audit And Tax Accounting The Big 4 Accounting Firms

Pros And Cons Of A Boutique Auditing Firm Versus Big 4 Tugboat Logic